We have helped a lot of people obtain home loans in the Perth area, but that isn’t all we do. We also provide business finance and have a team of financial planners. We have spent most of our business lives helping people in the Perth area achieve their dreams and we don’t plan on stopping any time soon.

Part of our job is to know financial planning and be able to determine patterns. These patterns affect every aspect of your personal and business finances. And one of the most reliable patterns we have seen over the years is that interest rates never stay low or high for a long time. They are usually somewhere in the middle.

Why Interest Rates Rise and Fall

The RBA uses the interest rate to keep the economy on an even keel. If the economy shrinks too fast, there is a recession or a depression. If it grows too fast, there is rampant inflation. The RBA’s intention is to keep the economy growing at a steady rate that is healthy for the economy.

When there are a lot of jobs, the property market is growing and the economy is strong, the growth reaches a level that causes inflation. Accordingly, the RBA raises their interest rates to slow down the growth and prevent inflation.

When the economy starts to suffer, the RBA lowers interest rates to stimulate loan activity and provide incentive for people to borrow and spend money, which makes the economy healthier.

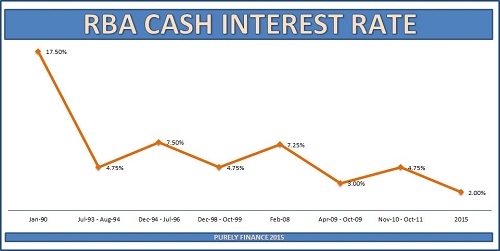

On 23 Jan 1990, the RBA cash interest rate was 17.50%. It would drop to 4.75% from 30 July 1993 to 31 August 1994. From December 1994 to July 1996, the rate was at 7.50%. From December 1998 to October 1999, it was 4.75%. By February 2008, the interest rate peaked again at 7.25%. From April 2009 to October 2009, it was 3.00%, which was a then-record low.

After rising to 4.75% from November 2010 to October 2011, it began its gradual slide to its current 2.00%.

Do you see the pattern? What goes up must come down and vice-versa. To learn more or to apply for a home loan, call our Perth office today: (08) 9453 8888.